what is a secondary property tax levy

113 rows The Pima County Property Tax Help Line can answer questions about how your property tax was calculated. 301 West Jefferson Street Phoenix Arizona 85003 Main Line.

Property Tax Calculation Boulder County

FY 202122 Tax Rate per 100 NAV FY 202021 Tax Rate per 100 NAV.

. The rates for the municipal portion of the tax are established by each municipality. The idea of a levy is that the government will take the property because you are unable. Levy Limits Homeowners Rebate Tax Deferral Exemptions.

AMPHI DESEGREGATION and TUSD DESEGREGATION adopted as secondary property taxes but included in computing the State. Notice is hereby given pursuant to Ariz. ESSB 6614 changed the rate based levy from 270 per 1000 market value to 240 per 1000 market value for the 2018 tax year.

Under state law cities and towns are allowed to levy a secondary property tax for the sole purpose of retiring the principal and interest on general obligation bonded indebtedness. Another tax that is levied on property owners is a property tax which is based on the governmental needs in the municipality where the property is located as well as the propertys value. Levy 2018 type 2019 taxes taxes 2019 tax summary totals secondary property tax prmreduction primary property tax special district tax property description total tax due for 2019 parcel number this is a calendar year tax notice this is the only statement you will receive.

Towns and cities use the proceeds from levying property taxes to fund the. The Surprise City Council will adopt the property tax on June 21 2022 at or after 600 pm at City Hall Council Chambers located at 16000 N. A levy is a legal seizure of your property to satisfy a tax debt.

Property taxes are one of the primary if not the only ways for municipalities to raise revenue for community services. A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes the property to satisfy the tax debt. The FY 202021 annual secondary property tax levy for the median-value City of Mesa residential property is 160.

For example in tax year 2016 Goodyears fiscal year 16-17 a Goodyear home had a LPV of 116424. Levies are different from liens. The secondary tax is.

In other words the levy is the cap on the amount of property tax dollars a local government is allowed by law to collect. The FY 202021 annual secondary property tax. The assessment ratio for residential properties is 10.

Therefore not paying your property taxes can result in the government seizing your property as payment. Property tax is a levy based on the assessed value of property. 15 that the City of Surprise intends to levy an increased primary and secondary property tax.

Starting in Tax Year 2015 Proposition 117 and ARS. The City will levy a secondary property tax each year until the General Obligation debt has been retired. In a two-tiered municipality a component of the rate is set by the upper-tier and a component is set by the lower.

A property tax levy is the right to seize an asset as a substitute for non-payment. FY 202021 Tax Levy chg. The principal deduction will still be limited to Rs 1 for second mortgages even if you have a second home loan.

Governments enforce a property tax levy as a measure of last resort. Secondary Tax Rates are used to fund such things as bond issues budget overrides and special district funding. 2020 TAX LEVY TABLE OF CONTENTS Note.

The act of imposing a tax on someone is called a levy. For principal repayment an amount maximum of Rs. Similar to those of the primary property tax levy limitations.

Provides a fine of up to Rs. 35-458 for the purpose of retiring the debt associated with the Surprise General Obligation Bonds which were approved by voters on November 7 2017. 1 may be deducted.

42-11001 Subsection 7b now requires using the Limited Property Value Net Assessed Value in determining and levying primary and secondary property taxes on. Where does Internal Revenue Service IRS authority to levy originate. Secondary Property Tax Levy debt repayment.

Since 2006 the amount of the secondary property tax levy has ranged from 008 cents to 019 cents per 100 of assessed value and the total amount collected has gone from 40 million to this year. The LPV is multiplied by an assessment ratio to reach the propertys assessed valuations AVs. The FY 2019-20 tax rate and levy were adjusted to fund new public safety and parks and cultural bonds approved by voters in November 2018.

The Internal Revenue Service IRS can impose levies on taxpayers to satisfy outstanding tax debts. How is the tax levy determined. A city or town may levy whatever amount of secondary property taxes is necessary to pay general obligation debt.

Secondary Property Tax SEC. EHB 2242 changed the state school levy from a budget based system limited by the one percent growth to a 270 per 1000 market value rate based property tax for the 2018 2021 tax years. 9 - 499.

Second homes can be taken out by individuals. Property tax has two components. The Arizona Constitution limits the total amount of primary property taxes that counties cities and community college districts can levy.

A municipal portion and an education portion. Levies are different from liens. A tax levy is the amount specific in dollars that a taxing unit city town township etc may raise each year in property tax dollars.

The Library District levy had a net increase of 782868 dollars Library debt service included and the The table and graph below shows the Countys 20-year history of primary and secondary property tax levies in millions. The secondary tax is comprised mainly of commitments to satisfy bond indebtedness of jurisdictions fund voter-approved budget overrides and to support the operations of the special taxing districts such as fire flood control street lighting and other limited purpose districts in which your property is located. The secondary property tax is used to cover the annual debt service payments and related administrative feesexpenses.

A property tax levy is the right to seize an asset as a substitute for non-payment. For more information on assessed value and property tax see the Budget and Financial Summary. Second home loans can also be taxed when the loan is paid off.

The City of Surprise will levy a secondary property tax pursuant to Ariz. Primary and secondary property taxes are then calculated per every 100 of a propertys AV.

Demystifying Utah S Property Tax Law And Why We Have The Best Property Tax Laws In The Nation Utah Taxpayers

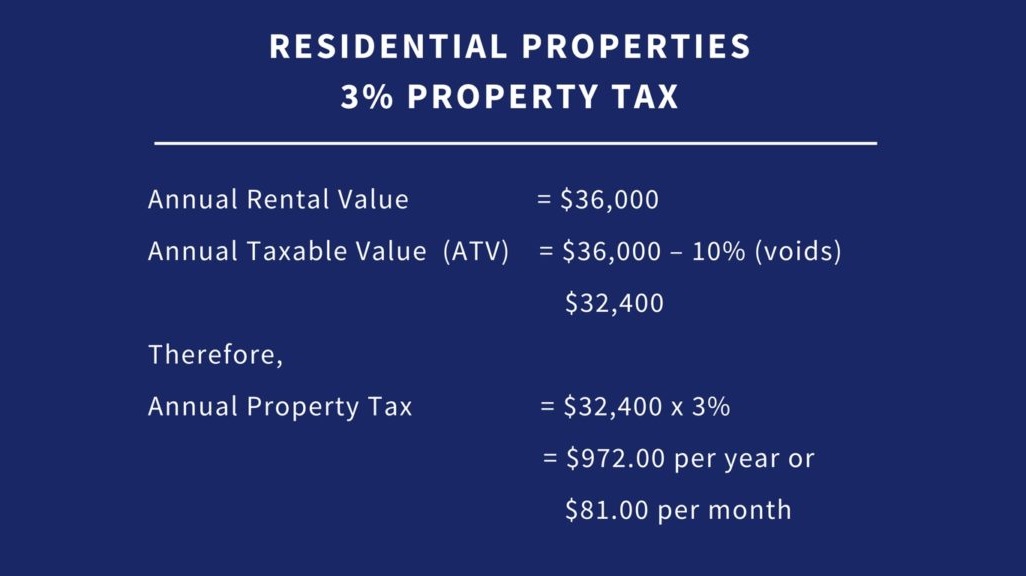

Updated 10 Things To Know About Property Tax Loop Trinidad Tobago

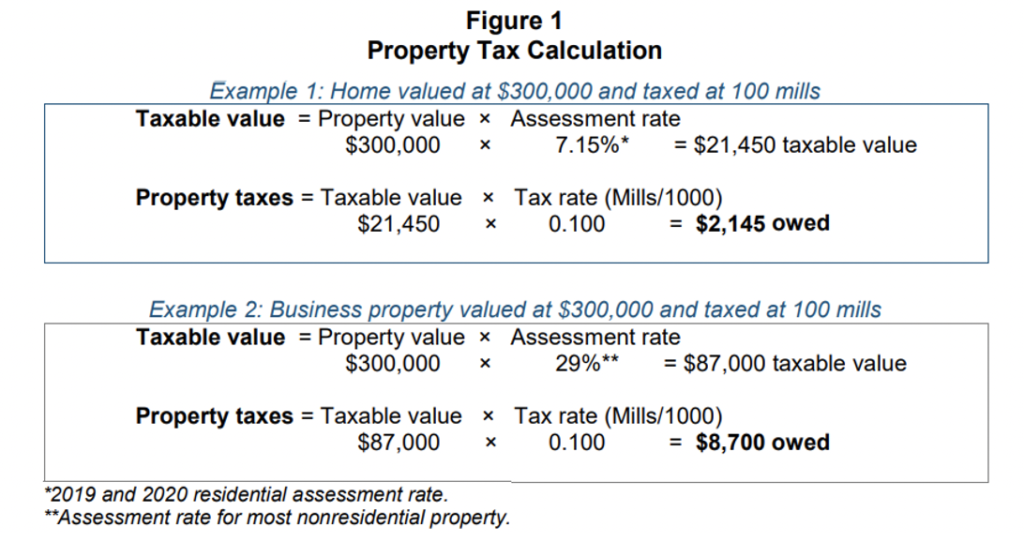

Property Tax How To Calculate Local Considerations

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

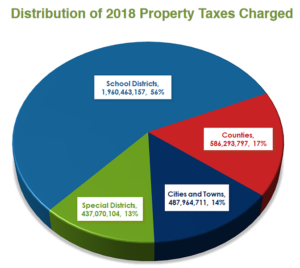

2018 County Property Tax Report Texas County Progress

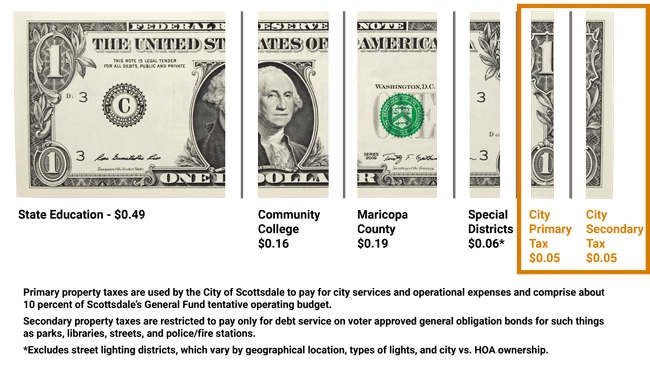

City Of Scottsdale Truth In Taxation Notice

Pennsylvania Property Tax H R Block

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Understanding California S Property Taxes

Around 40 Property Owners In Bengaluru Don T Pay Tax The Economic Times Paying Taxes Economic Times Bengaluru

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Understanding Your Property Tax Statement City Of Bloomington Mn

Understanding California S Property Taxes